Note: Nevada Revised Statutes section 608.0126 defines “workday” as “a period of 24 consecutive hours which begins when the employee begins work.” This is different from the typical twenty-four-hour period in a calendar day.

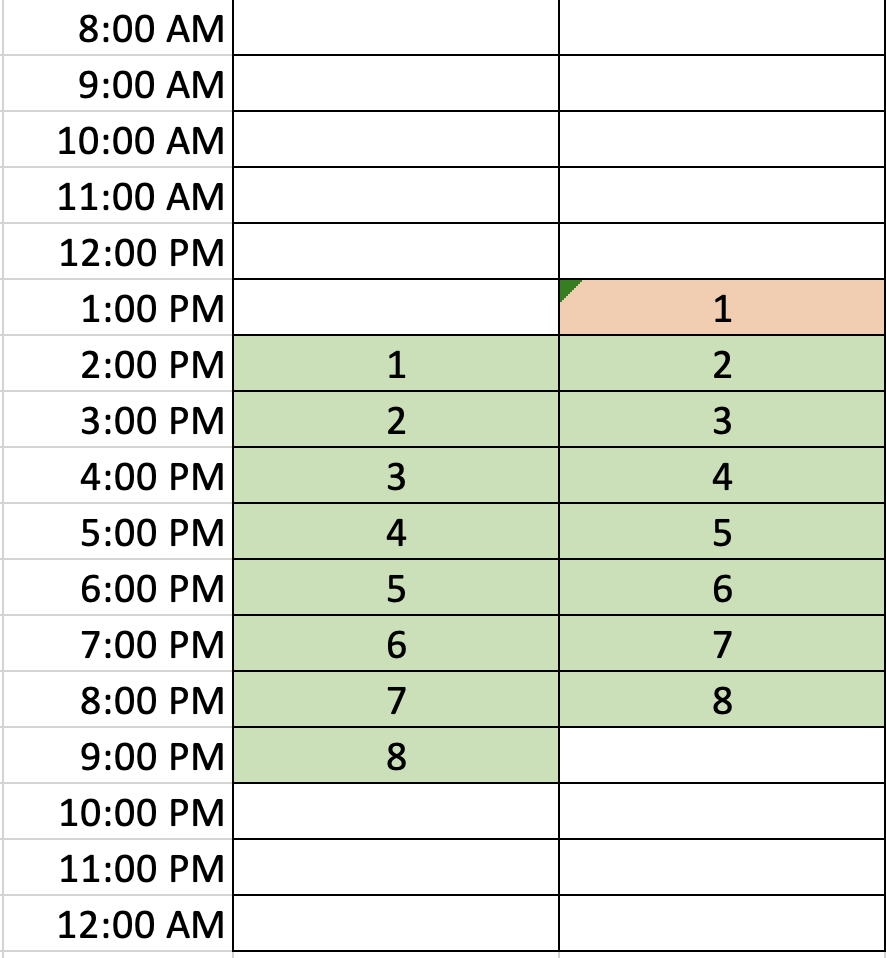

Example:

In the following example, an employee works two 8-hour shifts on consecutive days.

The shifts result in 1 hour of overtime, because the first hour of day#2 falls into the 24 hour span which began at 2pm on shift#1.

Note that if in day#2 that 9 hours were worked, the day would not result in overtime, because the same hour cannot contribute to overtime 2x.

Minimum Wage Settings: https://support.dolceclock.com/help/entering-and-updating-minimum-and-tipped-wage-rules

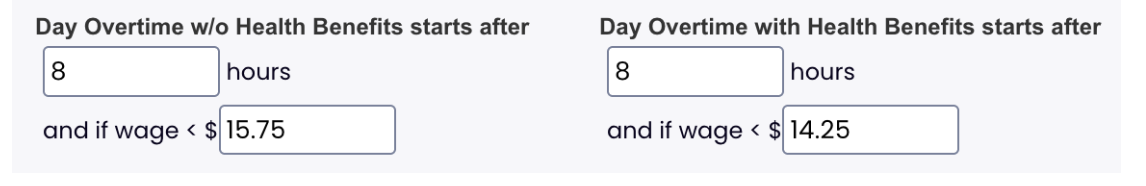

Nevada OT Settings:

From the gearwheel, scroll to pay-group settings. Set / update according to state minimum wage requirements:

References

https://www.leg.state.nv.us/nrs/nrs-608.html#NRS608Sec018

NRS 608.0126 “Workday” defined. “Workday” means a period of 24 consecutive hours which begins when the employee begins work.

(Added to NRS by 1985, 578)

NRS 608.018 Compensation for overtime: Requirement; exceptions.

1. An employer shall pay 1 1/2 times an employee’s regular wage rate whenever an employee who receives compensation for employment at a rate less than 1 1/2 times the minimum rate set forth in NRS 608.250 works:

(a) More than 40 hours in any scheduled week of work; or

(b) More than 8 hours in any workday unless by mutual agreement the employee works a scheduled 10 hours per day for 4 calendar days within any scheduled week of work.

2. An employer shall pay 1 1/2 times an employee’s regular wage rate whenever an employee who receives compensation for employment at a rate not less than 1 1/2 times the minimum rate set forth in NRS 608.250 works more than 40 hours in any scheduled week of work.

3. The provisions of subsections 1 and 2 do not apply to:

(a) Employees who are not covered by the minimum wage provisions of Section 16 of Article 15 of the Nevada Constitution;

(b) Outside buyers;

(c) Employees in a retail or service business if their regular rate is more than 1 1/2 times the minimum wage, and more than half their compensation for a representative period comes from commissions on goods or services, with the representative period being, to the extent allowed pursuant to federal law, not less than 1 month;

(d) Employees who are employed in bona fide executive, administrative or professional capacities;

(e) Employees covered by collective bargaining agreements which provide otherwise for overtime;

(f) Drivers, drivers’ helpers, loaders and mechanics for motor carriers subject to the Motor Carrier Act of 1935, as amended;

(g) Employees of a railroad;

(h) Employees of a carrier by air;

(i) Drivers or drivers’ helpers making local deliveries and paid on a trip-rate basis or other delivery payment plan;

(j) Drivers of taxicabs or limousines;

(k) Agricultural employees;

(l) Employees of business enterprises having a gross sales volume of less than $250,000 per year;

(m) Any salesperson or mechanic primarily engaged in selling or servicing automobiles, trucks or farm equipment;

(n) A mechanic or worker for any hours to which the provisions of subsection 3 or 4 of NRS 338.020 apply;

(o) A domestic worker who resides in the household where he or she works if the domestic worker and his or her employer agree in writing to exempt the domestic worker from the requirements of subsections 1 and 2; and

(p) A domestic service employee who resides in the household where he or she works if the domestic service employee and his or her employer agree in writing to exempt the domestic service employee from the requirements of subsections 1 and 2.

4. Any regulation of the Director of the Department of Health and Human Services concerning the payment of overtime to a home care employee adopted pursuant to NRS 608.670 prevails over the general provisions of this section.

5. As used in this section:

(a) “Domestic worker” has the meaning ascribed to it in NRS 613.620.

(b) “Home care employee” has the meaning ascribed to it in NRS 608.530.

(Added to NRS by 1975, 1583; A 1977, 1373; 1985, 578; 2003, 1742; 2005, 2520; 2009, 2493; 2017, 3886, 4178; 2019, 3746; 2021, 3659)